Can I Change My Medigap Policy at Any Time

1 in three Medicare beneficiaries also buys a Medicare Supplement plan, usually known as a Medigap policy, because it fills in many of the coverage gaps left by Medicare Parts A and B.one These plans tin can help tremendously with copayments and hospital expenses. They also pay for at to the lowest degree some claret transfusions.

Why Change Medicare Supplement Plans?

Yous may discover over fourth dimension that you lot'd similar to switch from one Medigap visitor or program to some other. According to the federal authorities'southward Medicare site,2 this generally happens for ane of the following reasons:

- You're paying for benefits you don't demand.

- You need more benefits.

- You want to change your insurance company.

- You want a policy that costs less.

How Can You Switch Medigap Policies?

Changing Medigap policies is more complicated than it was to switch insurance plans in the days before y'all entered the Medicare earth. Except in a handful of states, there aren't annual open enrollment periods for making the switch, and the restrictions are many.

Many people are dislocated by this because there is a menstruum in fall each year when you lot can alter aspects of your coverage, such every bit Medicare Part D drug plans. Merely things work differently with Medigap policies. Here's how to go about it.

When Can You Switch Your Medigap Policy?

The starting time time during which you can switch your Medigap policy without worrying virtually existence rejected for coverage is during the Medigap Open Enrollment Period, a half-dozen-calendar month period when you are 65 or older and have just enrolled in Medicare Part B. During this time, you can switch to another plan The company cannot deny the application or exclude whatsoever preexisting atmospheric condition or impose waiting periods, elimination or probationary periods into your new policy.

What If You lot Missed the Medigap Open Enrollment Menses?

What if you desire to change plans afterward your Medigap Open Enrollment Period? You might accept been enrolled in health insurance through your work at that time, for example. Under certain circumstances, you have a "guaranteed issue right" that enables you to purchase a Medigap policy at the best available rate, no thing what your electric current health status is.

What Is a "Guaranteed Issue Correct?"

Here are some of the circumstances that might entitle yous to guaranteed issue rights:3

- Y'all take coverage through a group health program that paid secondary to Medicare but ends for no reasons that are your error.

- You lot are quitting a Medicare Advantage program inside 12 months of enrolling in it, assuming it was the plan y'all starting time joined later becoming eligible for Medicare at age 65. Medicare Advantage plans are inclusive plans sponsored by private insurance companies that provide all Part A and Part B benefits, and normally include prescription drug coverage and other benefits.

- The insurance company that issued your previous plans stops offering coverage or commits fraud.

In other situations, if you no longer accept a guaranteed upshot correct, you tin apply for the Medigap policy of your choice, but with restrictions you had not faced before. At this betoken, insurance companies can crave medical screenings and raise your rates based on your health situation rather than offer you the best available rate, or they can pass up to sell you a policy altogether.

Be especially aware that in January 2020, insurers can no longer offer to newly eligible Medicare beneficiaries policies that include coverage for the Part B deductible. Those plans? Plan C and Programme F. Those who stay with their previous plans tin proceed that do good.

What Is a "Free-Look Period?"

You likewise can get a tryout month with your new policy if you like, called the "gratuitous-expect period." Be aware, it's non complimentary. People must pay for both policies that month until they decide at the end of 30 days whether to leave the old policy and stay with the new one, according to the government'due south Medicare website on changing Medigap plans.

Several states — California, Connecticut, Maine, Massachusetts, Missouri, New York, and Oregon — have more generous rules on switching Medigap plans, according to Boston College'southward Center for Retirement Research.4 California, for example, allows Medigap policy owners to store for new coverage each year without fear of being rejected for medical reasons. This happens during the thirty days immediately later on their birthday without a medical screening or a new waiting period. The new policy must accept the aforementioned or fewer benefits than the old policy.

An Alphabet of Medigap Policies

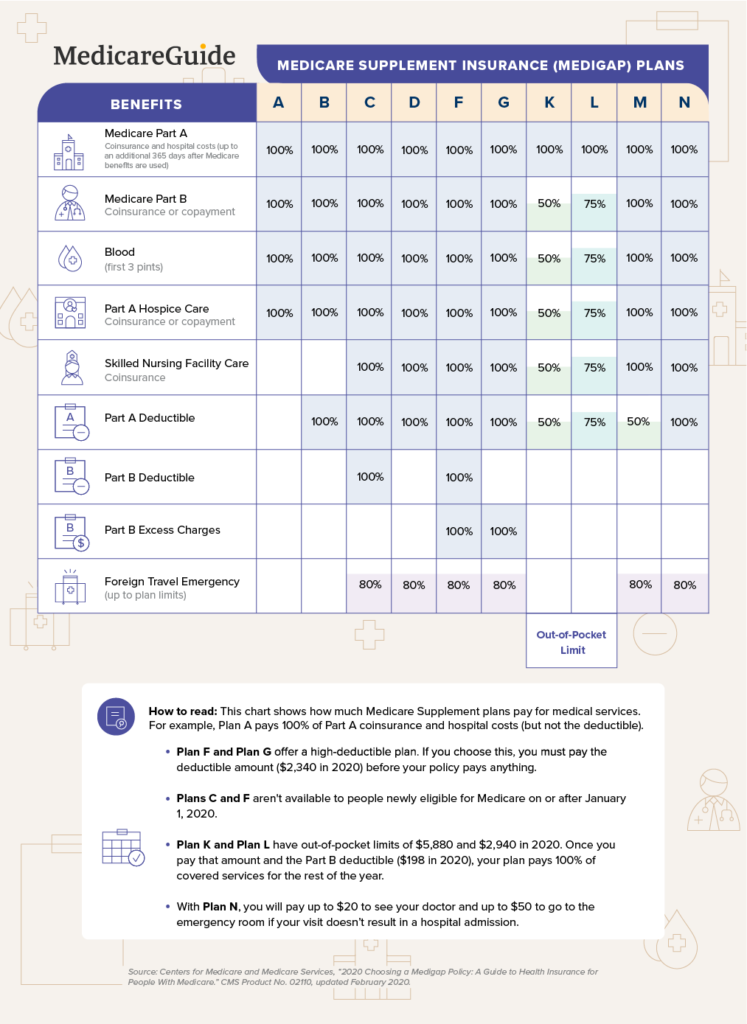

Across the nation, there is a confusing array of ten Medigap policies offer different levels of coverage. To compare them, you tin read this commodity on MedicareGuide.com or look at the chart beneath.

Keep in heed that Program C and Plan F are no longer available to newly eligible beneficiaries buying Medigap policies after January ane, 2020. Plan Grand is the closest to Plan F, which has offered the most comprehensive coverage. Programme G, though, does not cover the Part B deductible.

Some of the plans – C, D, F, Thou, Thou, and Due north – cover skilled nursing facilities; two don't at all and two others embrace a percentage. Only Plans F and Chiliad cover Part B excess charges. Plans K and L come with out-of-pocket limits for the beneficiary before they pick up full expenses.

Adjacent Steps

As with many kinds of insurance, the world of Medicare Supplement plans tin can feel overwhelming, with a whole new set of rules and restrictions. If you lot have had coverage and are looking for a change, switching your policy is even more complicated, depending on which land you lot live in and what level of coverage y'all seek.

Simply it tin can be done. Read over our nautical chart on Medigap benefits, look at whatsoever rules in your state that might affect you for better or worse, and cheque your situation against the restrictions outlined higher up. Ask for skilful, unbiased assist if you're even so uncertain. The conclusion you brand could touch your healthcare choices for a long time to come.

Source: https://medicareguide.com/change-medicare-supplement-plans-143655

0 Response to "Can I Change My Medigap Policy at Any Time"

Postar um comentário